March 2005

Over the past decade, SA’s car rental industry has undergone significant adjustments, the most significant of these being the increase in competitor activity resulting in a number of new and international brand operations setting up shop.

Competitive Forces

Pre-1995 there were four dominant players in SA car rental scene – Avis, Imperial, Budget and Tempest. Hertz was also present but as a “sub-brand” at Imperial counters. Effectively, there were two-and-a-half international brands plus two strong local brands.

Between 1995 and 1999: The opening up of SA trade to the world, combined with ACSA’s keenness to open up business at the main airports across SA, saw the number of car rental brands and players doubled to eight, with Hertz operating as a separate brand and Europcar, National/Alamo and then Thrifty moving onto the scene.

Due to the high growth of tourist traffic to the “New” South Africa, the abnormal increase in the number of players and the resultant high “cut-throat” competitive forces that had not existed pre-1998, this period saw significant increases in the car rental volumes handled.

Post 1999: Once the new players had settled in and signed contracts with ACSA and the substantial growth of foreign inbound visitors began to taper off, strong competitive forces and price cutting began to take effect in the car rental market.

By 2000, the eight major car rental operators began to consolidate their positions and strive for growth in market share, resulting in the price cutting and subsequent rate increase cycles which have almost become a “cyclical” trend in the industry.

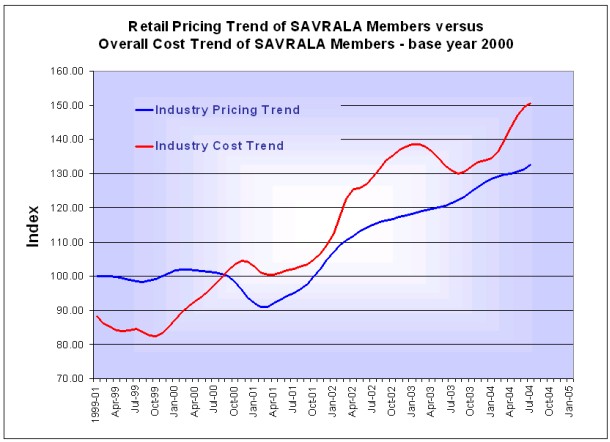

The points and graphs below aim to indicate the trend of rate increases over the past five years:

This following graph indicates the average daily Time and Kilometre (rate) revenue generated by SAVRALA car rental members over the past five years. These rates exclude revenue generated by the sale of waivers (often and incorrectly referred to as insurance).

1. Notice that as a result of excessive competitive forces, the rate yield dropped from the Year 2000 (blue line) to 2001 (pink line) by an average of less than 5% for the year – but severely in the first half. This was followed by some positive adjustment in 2002 (green) to correct the “destructive” price cutting of 2001 (up by 13%). The following two years to end-2004, saw annual increases of 5% and 4% respectively, with current competitive forces at play and rates dipping below the previous year levels toward the end of 2004.

2. Over the four year period 2000 to 2004, average car rental rates have only increased by around 4% per annum, from R149 per day (in 2000), to an average of R168 in 2004.

3. Revenue from waivers are a significant portion of the car rental bill and need to be taken into account when looking at the overall pricing picture of car rental charges. Unfortunately, the industry does not measure the Waiver sales portion of the rate charges. However, some insight is provided in the next paragraph to include waiver revenue accordingly.

4. When including Waiver revenue, on average, the “total” daily revenue per rental day was around R260 in 2004. This may be higher or lower, depending on which segment the business is transacted in – for example, many local companies cover car rental within their own corporate policies, so waiver revenue hit rates are lower.

On the other hand, foreign-inbound business tends to have a higher rate of waiver acceptance. However, the high degree of competition in this segment has led to a further erosion of the T & K portion of the revenue stream and has reduced yield while affording the waiver protection. Instead of being closer to the R300 level, the daily total revenue is substantially lower.

5. The improved strength in the rand over the past two years will have impacted no doubt as an “increase” in the cost of car rental to the foreign-inbound segment, exacerbating the perception by the Foreign Tour Operators that the SA car rental market has become very expensive. The fact is that car rental in SA is still relatively inexpensive when compared to other tourist destinations.

6. Despite the afore-going factors, the average daily cost of car rental in South Africa is regarded as inexpensive in the overall “travel spend” basket. When one compares a 30 to 45 minute transfer journey from the airport to a city hotel in Johannesburg, Cape Town or Durban that can cost anything R300 and R500, as opposed to the freedom of driving “your own” hired vehicle for 24 hours at a similar or less charge, which option would most travelers prefer?

7. When one compares daily car rental charges with those of corporate hotels (three or four star) some 10 years ago, they were very similar in cost. Today, however, the average daily car rental rate of R250 (including waiver revenue) is substantially less that of a hotel’s daily room charge which is closer to double the cost of car rental.

8. At an average of R250 (or $43 or 21 UK Pounds per day including waiver cover), car rental travel in SA today is regarded as a fairly reasonably and inexpensive item in tourists’ travel budgets. Consider, too, that South Africa does not have a strong public transport infrastructure to support tourist travel making car rental, transfer shuttles and coach tours, the main means of road travel. With such a limited choice of other modes of transport, one would expect that car rental should command higher rates. This, however, is not the case.

9. As can be seen by the T & K (rate) yield graph, competitive forces continue to keep the lid on pricing in the local car rental industry. Since the latter part of 2004, statistics have indicated that rate increases are once again under extreme pressure.

10. The Cost to Revenue Trend Monitor graph also provides clear indication that car rental revenues have increased at a pace substantially lower than the cost, a phenomenon which has beset the industry over the past five years. The main factors driving up costs have been damage and vehicle theft, salaries, vehicle servicing and petrol increases. This has placed pressure on a number of the operators and has seen improvements in fleet utilization from an average of 70% in 2000 to almost 77% in 2004. This is a significant and very necessary improvement in order to keep costs under some degree of control.

11. Many feel that with the stagnation of new vehicle price increases, car rental rates should also remain stagnant. However, car rental operators sell off their fleets within 11 months and “low” new car prices impact negatively on the residual values of these used vehicles, thereby effectively driving “up” the cost of holding vehicles on fleet.